jo0.site

Market

401k Vs Ira Taxes

The biggest difference between a (k) and IRA is flexibility. You can open an IRA at most financial institutions, and the range of investments to choose from. Traditional IRAs, (k)s and (b)s may contain after-tax contributions that are not subject to income taxes. If they do, there are special tax rules to. A big difference in (k) vs. Roth IRA is the contribution amount. Also, (k) contributions are tax-deductible; Roth IRA deposits aren't but withdrawals. Roth IRA contributions, by comparison, are capped at $6,—$7, if you're 50 or older. Matching contributions: Roth (k)s are eligible for matching. A rollover IRA is a retirement account that allows you to move money from your former employer-sponsored plan to an IRA—tax and penalty-free. Traditional IRAs are tax deferred, just like traditional (k)s — which means your contributions are tax deductible in the year you make them, but taxes are. When taking withdrawals from an IRA before age 59½, you may have to pay ordinary income tax plus a 10% federal penalty tax. Traditional IRA. A 10% penalty on withdrawals made before age 59½. There are some exceptions. ; Roth IRA. A 10% penalty on withdrawals of investment earnings. Roth (k), Roth IRA, and pre-tax (k) retirement accounts · – modified AGI married $,/single $, · – modified AGI married $,/single. The biggest difference between a (k) and IRA is flexibility. You can open an IRA at most financial institutions, and the range of investments to choose from. Traditional IRAs, (k)s and (b)s may contain after-tax contributions that are not subject to income taxes. If they do, there are special tax rules to. A big difference in (k) vs. Roth IRA is the contribution amount. Also, (k) contributions are tax-deductible; Roth IRA deposits aren't but withdrawals. Roth IRA contributions, by comparison, are capped at $6,—$7, if you're 50 or older. Matching contributions: Roth (k)s are eligible for matching. A rollover IRA is a retirement account that allows you to move money from your former employer-sponsored plan to an IRA—tax and penalty-free. Traditional IRAs are tax deferred, just like traditional (k)s — which means your contributions are tax deductible in the year you make them, but taxes are. When taking withdrawals from an IRA before age 59½, you may have to pay ordinary income tax plus a 10% federal penalty tax. Traditional IRA. A 10% penalty on withdrawals made before age 59½. There are some exceptions. ; Roth IRA. A 10% penalty on withdrawals of investment earnings. Roth (k), Roth IRA, and pre-tax (k) retirement accounts · – modified AGI married $,/single $, · – modified AGI married $,/single.

With a traditional (k), you make contributions with pre-tax dollars, so you get a tax break up front, helping lower your current income tax bill. Your money—. The answer to your question: “Is a K a traditional IRA?” is no. There is a difference between K and traditional IRA accounts. Your contributions are not taxed at the time of investment. Instead, taxes are paid on withdrawals, including any earnings. Getting a tax break at the time of. Key Points · A Roth (k) is similar to a Roth IRA in that you deposit after-tax funds, and withdrawals in retirement are tax free. · The difference is that a. Learn the difference between an IRA and a (k), including the benefits, tax and rollover rules, contribution limits, and which account may be best for. There are no penalties on withdrawals of Roth IRA contributions. But there's a 10% federal penalty tax on withdrawals of earnings. Exceptions to the penalty tax. At retirement, someone who withdraws funds from a traditional IRA will need to pay taxes on their withdrawal; with Roth accounts, the taxes have already been. Anyone with eligible earned income can open an IRA, but a (k) is only available through an employer. · A (k) has a higher contribution limit than an IRA. k contributions are not subject to income limits and are always tax advantaged. Call it a Draw: When the Answer Can Be “Both”. Depending on your. You're less likely to miss money that never shows up in your pocket or bank account in the first place—a behavior tested by time and science. Traditional IRA vs. A feature of both traditional (k) and IRA retirement plans is that when you begin taking money out, it's all taxed as ordinary income, even if some of your. Roth IRA contributions, by comparison, are capped at $6,—$7, if you're 50 or older. Matching contributions: Roth (k)s are eligible for matching. The key difference between a (k) and Roth (k) is how your funds are taxed. With Roth contributions, your money is taxed before it goes in. But then it. A Traditional (or Rollover) IRA is typically used for pre-tax assets because savings will stay invested on a tax-deferred basis and you won't owe any taxes on. "Saving in a Roth (k) could be a better way to go if the taxes on a Roth IRA conversion are prohibitive." Higher contribution limits: In , you can. With a traditional (k), taxes are not paid on the amount deposited into the account, and withdrawals are considered taxable income. You deposit after-tax. A traditional IRA is a tax-deferred retirement savings vehicle. Contributions are made with pretax funds, similar to a (k). When distributions are taken in. Contributing to an IRA or k offers tax benefits such as reducing taxable income, tax-deferred growth, and potentially lowering tax brackets. Still, the. An IRA is not an investment. It's an account type that allows for tax-deferred or tax-free growth on your retirement savings contributions. An IRA includes all the tax benefits of a k plan but also provides the benefit of control over your retirement investments.

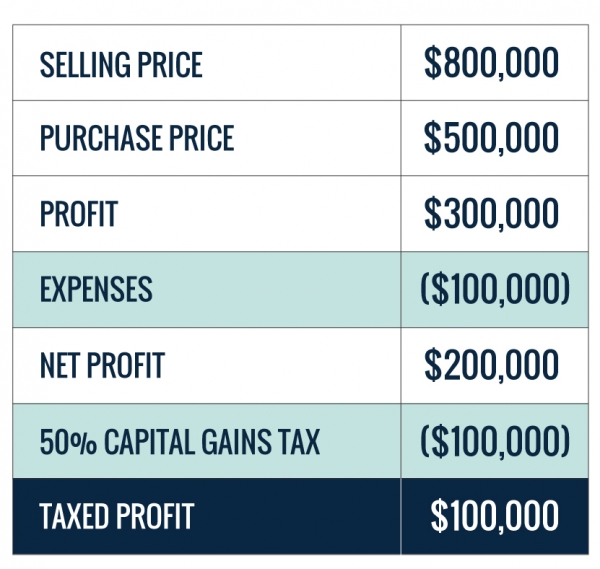

Investment Gain Tax

A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes. Learn more. Tax-loss harvesting is when you sell some of your investments at a loss to help offset capital gains. They're subject to a 0%, 15%, or 20% tax rate, depending on your level of taxable income. Short-term capital gains are gains on investments you owned 1 year or. Capital Gains Tax. In most cases, capital gains tax is paid after selling an asset (like stocks or real estate). This usually happens when you file your tax. Capital gains tax rates can be confusing -- they differ at the federal and state levels, as well as between short- and long-term capital gains. Updated Capital gains tax by state table for each state in the country and D.C.. Capital gains state tax rates displayed include federal max rate at. The rates are 0%, 15%, or 20%, depending on your income level; essentially, the higher your income, the higher your rate. The income thresholds for long-term. In the United States, individuals and corporations pay a tax on the net total of all their capital gains. The tax rate depends on both the investor's tax. Capital gains are taxed based on the several factors including the type of asset, how long you held the asset, and your overall income level. A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes. Learn more. Tax-loss harvesting is when you sell some of your investments at a loss to help offset capital gains. They're subject to a 0%, 15%, or 20% tax rate, depending on your level of taxable income. Short-term capital gains are gains on investments you owned 1 year or. Capital Gains Tax. In most cases, capital gains tax is paid after selling an asset (like stocks or real estate). This usually happens when you file your tax. Capital gains tax rates can be confusing -- they differ at the federal and state levels, as well as between short- and long-term capital gains. Updated Capital gains tax by state table for each state in the country and D.C.. Capital gains state tax rates displayed include federal max rate at. The rates are 0%, 15%, or 20%, depending on your income level; essentially, the higher your income, the higher your rate. The income thresholds for long-term. In the United States, individuals and corporations pay a tax on the net total of all their capital gains. The tax rate depends on both the investor's tax. Capital gains are taxed based on the several factors including the type of asset, how long you held the asset, and your overall income level.

Long-term capital gains on investments held for more than a year are taxed at the rate of 0%, 15% or 20%, depending on your taxable income and tax filing status. (Some types of capital gains may be taxed as high as 25 percent or 28 percent.) The actual process of calculating tax on long-term capital gains and qualified. All you need to know about capital gains tax and how it affects your investment earnings. The corporate capital gains tax rate is the same as the ordinary tax rate, a flat 21 percent. Corporations prefer the corporate capital gains tax because the. The rates are 0%, 15%, or 20%, depending on your income level; essentially, the higher your income, the higher your rate. The income thresholds for long-term. One prominent proposal would be to tax capital gains as they accrue instead of waiting until an asset is sold, an approach sometimes known as “mark-to-market.”. Capital gains taxes serve as investment income taxes assigned to certain assets on which you made money. Whether it's stocks, bonds or property, any money you. If you hold an investment for more than a year before selling, your profit is considered a long-term gain and is taxed at a lower rate. The Federal rates are 0%, 15%, or 20%, depending on filing status and taxable income. Each state may also have a capital gains tax, but each treats them. Use tax-advantaged accounts. An easy and impactful way to reduce your capital gains taxes is to use tax-advantaged accounts. Retirement accounts such as (k). Long-term capital gains are typically taxed at lower rates, meaning there may be a benefit to holding onto your assets for longer before you sell them. With changes in the capital gains tax rates, it is important to understand what capital gain tax is and how it can affect you. Learn more here. Auten, Gerald. “Capital Gains Taxation.” In Encyclopedia of Taxation and Tax Policy, 2nd ed., edited by Joseph Cordes, Robert Ebel, and Jane Gravelle. Some taxes are due only when you sell investments at a profit, while other taxes are due when your investments pay you a distribution. A 7% tax on the sale or exchange of long-term capital assets such as stocks, bonds, business interests, or other investments and tangible assets. Capital gains. If you sell an asset for more than you paid for it, your profit (minus your cost basis) is called a capital gain. Short-term capital gains are. Russia · Capital gains of individual taxpayers are tax free if the taxpayer owned the asset for at least three years. · Capital gains of resident corporate. This calculator shows the capital gains tax on a stock investment, using the new Federal capital gains rates. A capital gain is the profit you make from selling or trading a "capital asset." With certain exceptions, a capital asset is generally any property you hold. Different tax rates apply for long- and short-term capital gains. As of February 11, , the tax rate on most net capital gain is 15% for most individuals.

How Do You Get Pmi Removed

The answer to that question is yes. Equity One path to removing PMI from your mortgage without refinancing is to build up the equity in your home. When you reach 80% loan-to-value (“LTV”), you can use this form to request BSI. Financial Services (“BSI”) to remove the PMI. BORROWER INFORMATION. Loan Number. 4 options to get rid of PMI · Wait for PMI to terminate automatically. · Request PMI cancellation. · Refinance to get rid of PMI. · Refinance into a piggyback loan. The law generally provides two ways to remove PMI from your home loan: (1) requesting PMI cancellation or (2) automatic or final PMI termination. 4 options to get rid of PMI · Wait for PMI to terminate automatically. · Request PMI cancellation. · Refinance to get rid of PMI. · Refinance into a piggyback loan. Can I remove PMI from my mortgage? Yes, you might be able to cancel your private mortgage insurance (PMI). After a week of back and forth PMI was removed and I saw my monthly payment drop. Overall this was a few hours of work and saved me over $8k over the life of. Can refinancing help lower or remove my PMI? Yes, if the value of your home has increased enough to reduce your loan-to-value ratio (LTV) to 80% or less. You can request that your lender remove PMI once the principal balance of your loan reaches 80% of the original value of the property. The answer to that question is yes. Equity One path to removing PMI from your mortgage without refinancing is to build up the equity in your home. When you reach 80% loan-to-value (“LTV”), you can use this form to request BSI. Financial Services (“BSI”) to remove the PMI. BORROWER INFORMATION. Loan Number. 4 options to get rid of PMI · Wait for PMI to terminate automatically. · Request PMI cancellation. · Refinance to get rid of PMI. · Refinance into a piggyback loan. The law generally provides two ways to remove PMI from your home loan: (1) requesting PMI cancellation or (2) automatic or final PMI termination. 4 options to get rid of PMI · Wait for PMI to terminate automatically. · Request PMI cancellation. · Refinance to get rid of PMI. · Refinance into a piggyback loan. Can I remove PMI from my mortgage? Yes, you might be able to cancel your private mortgage insurance (PMI). After a week of back and forth PMI was removed and I saw my monthly payment drop. Overall this was a few hours of work and saved me over $8k over the life of. Can refinancing help lower or remove my PMI? Yes, if the value of your home has increased enough to reduce your loan-to-value ratio (LTV) to 80% or less. You can request that your lender remove PMI once the principal balance of your loan reaches 80% of the original value of the property.

Borrowers may request cancellation of a mortgage insurance policy by writing the current lender asking for a review and removal of PMI. Ways to remove PMI PMI can be removed during a refinance if you have reached 20% equity. You can speed up the process of reaching % by making extra. To request cancellation of PMI, you should contact your loan servicer when the loan balance falls below 80 percent of your home's original value (the contract. You can typically request PMI be removed once you've reached 20% equity in your home in many cases as long as the value is verified. You will also need to be. Can PMI ever be removed. Sorry, this post was deleted by the person who originally posted it. PMI can be removed on an FHA mortgage is if you. If your payments are current and in good standing, your lender is required to cancel your PMI on the date your loan is scheduled to reach 78% of the original. The very first step to remove Private Mortgage Insurance is to contact the mortgage servicer and request the details regarding PMI cancellation. Private mortgage insurance (PMI) protects the mortgage company if you default. · PMI adds significant expense to a mortgage payment. · Mortgage insurance premiums. Depending on the FHA loan application date, there are different options for removing FHA monthly mortgage insurance, which will be discussed in this article. We offer a free initial consultation and will help you to determine if you have sufficient equity in your home to enable you to cancel your PMI. *PMI removal is not guaranteed in all cases where 80% LTV is reached. 3. Recast your loan. A loan recast is another great approach to removing PMI. If a recast. Removing PMI · Your property must reach at least 20% equity—or 80% LTV—to be eligible for an early cancellation. · Also, other conditions may apply to early. First, you have the right to request the removal of PMI when your principal loan balance is scheduled to fall below 80% of your home value. Please use the FHA MIP Removal Request Application if your loan is FHA Insured. Eligibility Checklist: • You must be current on your mortgage payments. • No. Once you've built equity of 20% in your home, you can cancel your PMI and remove that expense from your monthly payment. If you're current on your mortgage. *PMI removal is not guaranteed in all cases where 80% LTV is reached. 3. Recast your loan. A loan recast is another great approach to removing PMI. If a recast. After a few years of payments on your original loan, you may be able to refinance and remove your PMI payments. With a refinancing, you will use your home's. The best way to avoid PMI is to make a down payment of at least 20% of the home's purchase price. If you don't have a big down payment, ask your lender about. Can I remove PMI from my mortgage? Yes, you might be able to cancel your private mortgage insurance (PMI). The Homeowners Protection Act has one final option to remove PMI. If for some reason PMI was not canceled by request or automatic termination, the loan servicer.

Extended Warranty For Chevy

A Chevrolet Extended Warranty From Chrysler Factory Warranty Will Keep You Covered Past Your Factory Warranty. Instant Online Quote! Limited warranties cannot be cancelled. Vehicle Service Contract (Protection Plan). A vehicle service contract covers failure of specific parts. It can be added. Chevrolet offers three extended warranties that can last up to 8 years or , miles and cover various vehicle systems in the event of a breakdown. We created the Chevrolet Protection Plan 1. It's an easy way for you to purchase additional coverage on top of your manufacturer's limited warranty. When you purchase a new Chevy, you automatically receive a 3-year/36,mile, whichever comes first, Bumper-to-Bumper Limited Warranty. Now, you have the. Getting a tailored quote for a Genuine GM Extended Warranty is simple and straightforward with Matick Chevrolet. Call us at or fill out the. Chevrolet Protection Plan gives you additional coverage beyond your warranty, to protect you from repair costs due to mechanical breakdowns. An extended warranty scam is a predatory offer, usually issued not by a warranty company but rather by a broker or sales organization that is trying to get you. Bumper-to-Bumper Extended Warranty · First 3 years or 36, miles of ownership · Vehicle components from the front to the back bumper · Air Conditioning. A Chevrolet Extended Warranty From Chrysler Factory Warranty Will Keep You Covered Past Your Factory Warranty. Instant Online Quote! Limited warranties cannot be cancelled. Vehicle Service Contract (Protection Plan). A vehicle service contract covers failure of specific parts. It can be added. Chevrolet offers three extended warranties that can last up to 8 years or , miles and cover various vehicle systems in the event of a breakdown. We created the Chevrolet Protection Plan 1. It's an easy way for you to purchase additional coverage on top of your manufacturer's limited warranty. When you purchase a new Chevy, you automatically receive a 3-year/36,mile, whichever comes first, Bumper-to-Bumper Limited Warranty. Now, you have the. Getting a tailored quote for a Genuine GM Extended Warranty is simple and straightforward with Matick Chevrolet. Call us at or fill out the. Chevrolet Protection Plan gives you additional coverage beyond your warranty, to protect you from repair costs due to mechanical breakdowns. An extended warranty scam is a predatory offer, usually issued not by a warranty company but rather by a broker or sales organization that is trying to get you. Bumper-to-Bumper Extended Warranty · First 3 years or 36, miles of ownership · Vehicle components from the front to the back bumper · Air Conditioning.

Extended warranty - $ - extends 'bumper - bumper' from 3/36K to 6yrs/k miles with $ deductible. Via 3rd party - not sure why they're. An extended warranty can help you feel more confident each time you hit the roads of Inland Empire. Each plan varies, but if applicable, you can select. Extended Limited Warranty. Give your factory warranty a little more elasticity with this plan. You can extend the original 3-year/36,mile warranty into a 5. Vehicle Service Contract (Protection Plan). A vehicle service contract covers failure of specific parts. It can be added at the time of vehicle purchase at an. Your new Chevrolet comes with a standard 3-year/36,mile limited warranty. Or you can choose the 5 year/60, mile Chevrolet Extended Limited Warranty. An. This warranty covers the first 5 years or 60, miles for and may be selected only at the time of new vehicle purchases. It doesn't require car owners to pay a. Chevrolet dealer, Knapp Chevrolet. Extended warrant coverage for your new GM car or truck. The much more luxurious extended warranties that cover absolutely everything go for more than $ a month for 72 months. That's ANOTHER brand. Chevrolet dealer, Knapp Chevrolet. Extended warrant coverage for your new GM car or truck. When you buy most new Chevrolet vehicles, you have the option to purchase an extended warranty. This extends your factory limited warranty coverage to 5 years. The PowerUP Protection Plan provides two extra years of warranty coverage is on top of three-year manufacturer's warranty (for a total of a five-year warranty). What coverage levels does the Protection Plan offer? There are two levels of coverage offered through the Protection Plan: Silver and Platinum. Silver provides. GMEPP offers genuine GM extended warranty plans at an affordable price! Our plans are the most respected in the industry for over 30 years - FREE QUOTE! We created the Chevrolet Protection Plan 1. It's an easy way for you to purchase additional coverage on top of your manufacturer's limited warranty. An extended vehicle warranty can help put your mind at ease. This coverage can help take care of a hefty repair bill that you would normally have to pay for. When you purchase a new Chevy, you automatically receive a 3-year/36,mile, whichever comes first, Bumper-to-Bumper Limited Warranty. Now, you have the. When you buy most new Chevrolet vehicles, you have the option to purchase an extended warranty. This extends your factory limited warranty coverage to 5 years. Chevrolet, GMC Extended Warranty Coverage · Protection Plans – Get extended protection on top of the factory warranty · Pre-Paid Maintenance – Pay ahead for. Extended vehicle warranties are available from manufacturers and third-party providers. Manufacturers' extended warranties are sold by dealerships and generally. An extended warranty is generally worth it. Just make sure there's no remaining original warranty coverage still active!

Vrfb Stock Price

Historical stock prices. Current Share Price, CA$ 52 Week High, CA$ 52 Week Low, CA$ Beta, 11 Month Change, %. A: Generally it is days if the goods are in stock,or A: After price confirmation, you can require for samples to check our product's quality. VRB | Complete Vanadiumcorp Resource Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. The global Vanadium Redox Flow Battery (VRFB) market size is estimated to be worth USD million in and is forecast to a readjusted size of USD million by. So the obvious conclusion is that the remaining % of VRFB-H's shares Mustang Energy Share Price Alert · Home · Investing · Stocks · UK · LSE · Mustang. Electrolyte Supplier for VRFB C Critical Metals. Back to Main Menu End of Day Stock Quote. Events & Presentations. Unsubscribe. Submit Sign Up. Get Vanadiumcorp Resource Inc (VRB.V) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Vanadiumcorp Resource Inc. (jo0.site): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock (VRFB). The Iron-T Property is. PREV. CLOSE. ; VOLUME. 10, ; MARKET CAP. M ; 52 WEEK RANGE. – ; Key Statistics. Shares Outstanding M · Price to Book Ratio 1 Year. Historical stock prices. Current Share Price, CA$ 52 Week High, CA$ 52 Week Low, CA$ Beta, 11 Month Change, %. A: Generally it is days if the goods are in stock,or A: After price confirmation, you can require for samples to check our product's quality. VRB | Complete Vanadiumcorp Resource Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. The global Vanadium Redox Flow Battery (VRFB) market size is estimated to be worth USD million in and is forecast to a readjusted size of USD million by. So the obvious conclusion is that the remaining % of VRFB-H's shares Mustang Energy Share Price Alert · Home · Investing · Stocks · UK · LSE · Mustang. Electrolyte Supplier for VRFB C Critical Metals. Back to Main Menu End of Day Stock Quote. Events & Presentations. Unsubscribe. Submit Sign Up. Get Vanadiumcorp Resource Inc (VRB.V) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Vanadiumcorp Resource Inc. (jo0.site): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock (VRFB). The Iron-T Property is. PREV. CLOSE. ; VOLUME. 10, ; MARKET CAP. M ; 52 WEEK RANGE. – ; Key Statistics. Shares Outstanding M · Price to Book Ratio 1 Year.

What Is the Vanadiumcorp Resource Inc Stock Price Today? The Vanadiumcorp Resource Inc stock price today is What Is the Stock Symbol for Vanadiumcorp. The bid & ask refers to the price that an investor is willing to buy or sell a stock. VRFB systems. The firm operates in two segments: Exploration and the. The lowest price per MWh stored & discharged over the lifetime of the battery. Proven. Demonstrated performance in commercial applications in the field. Watch. Complete Testing Package for Vanadium Redox Flow Battery - VRB-CTP-LD. Sale Price: RFQ. If you are international, please click this. In stock. Item Number: VRB. Get Vanadiumcorp Resource Inc (VRBFF:OTCPK) real-time stock quotes, news, price and financial information from CNBC. The stock options are exercisable for a period of five years at an exercise price market for long-duration Vanadium Redox Flow Batteries (VRFB). The. VRFB 90° - 90° Flow Regulator Valves ; Code V, Type VRFB 90° 1/4”, Net Price € ; Code V, Type VRFB 90° 3/8”, Net Price € ; Code V, Type VRFB. VRFB stock quote, chart and news. Get VRFB's stock price today. The VRFB is uniquely suited for applications that require medium- to long-duration energy storage from 4 to 12 hours. The Vanadium Redox Flow Battery (VRFB) market report by Verified Market Research provides an in-depth analysis of the current and future. Will VRBFF stock price drop / fall? Yes. The Vanadiumcorp Resource stock price may drop from USD to USD. The change will be %. PREV. CLOSE. ; VOLUME. ; MARKET CAP. M ; 52 WEEK RANGE. – ; Key Statistics. Shares Outstanding M · Price to Book Ratio 30 Day. (VRFB) to reduce VRFB costs to customers. Address. 55 University Ave Suite Toronto, ON M5J 2H7 Canada. Website. jo0.site Executives. Francesco D. See the latest Australian Vanadium Ltd stock price (AVL:XASX), related news VRFB systems. The firm operates in two segments: Exploration and Energy. The VRFB is uniquely suited for applications that require medium- to long-duration energy storage from 4 to 12 hours. Research VRB stock prices, stock quotes, stock trends and price history (VRFB). The Iron-T Property is located in the Nord -du-Quebec. Electrolyte processing. Proprietary and patented VRFB electrolyte processing technology ; Stack technology. Utilization of industry-leading flow battery stack. Stryten's VRFB is the ideal option for large-scale energy storage and is The power needed for railway rolling stock applications and signaling equipment. The global Vanadium Redox Flow Battery (VRFB) market size was USD Million in and is expected to register a revenue CAGR of % during the forecast. Other substantial costs come from materials and components in the cell stack (see below) including the membrane, bipolar plates, electrodes, gaskets, etc. VRFB.

How To Open Up A Cd Account

If your bank doesn't offer custodial accounts, do a quick search online, and you'll be presented with plenty of options. Opening a custodial account is similar. FDIC Insured. Bank of Hope's CD accounts are covered by the FDIC insurance up to the maximum allowed by law. Many Term. Special Interest Rate CDs require a $5, minimum opening deposit unless otherwise noted. Public funds are not eligible for these offers. Special Interest. CDs offer a satisfying and stable way to grow your savings. Earn a competitive yield and receive a guaranteed rate for the entire term of your CD. Write up to account open and in good standing at the time of account opening. Checking account may be opened concurrently with Promotional CD account. Promotional Online CDs: Funds must be new money; deposits cannot be made from an existing NexBank CD account. Interest rates and APYs are subject to change. Unlike a savings account, funds in a CD are not accessible until the maturity date has been reached. How do Certificates of Deposits work? Opening a CD account. Open an Account. Checking · Savings · Credit Cards · CD · Personal Loans & Lines Set up ACH Payments · Set up Direct Deposit · ATM Banking · Activate Your New. Special Interest Rate CDs require a $5, minimum opening deposit unless otherwise noted. Public funds are not eligible for these offers. Special Interest. If your bank doesn't offer custodial accounts, do a quick search online, and you'll be presented with plenty of options. Opening a custodial account is similar. FDIC Insured. Bank of Hope's CD accounts are covered by the FDIC insurance up to the maximum allowed by law. Many Term. Special Interest Rate CDs require a $5, minimum opening deposit unless otherwise noted. Public funds are not eligible for these offers. Special Interest. CDs offer a satisfying and stable way to grow your savings. Earn a competitive yield and receive a guaranteed rate for the entire term of your CD. Write up to account open and in good standing at the time of account opening. Checking account may be opened concurrently with Promotional CD account. Promotional Online CDs: Funds must be new money; deposits cannot be made from an existing NexBank CD account. Interest rates and APYs are subject to change. Unlike a savings account, funds in a CD are not accessible until the maturity date has been reached. How do Certificates of Deposits work? Opening a CD account. Open an Account. Checking · Savings · Credit Cards · CD · Personal Loans & Lines Set up ACH Payments · Set up Direct Deposit · ATM Banking · Activate Your New. Special Interest Rate CDs require a $5, minimum opening deposit unless otherwise noted. Public funds are not eligible for these offers. Special Interest.

Open a 12 month term online. Annual percentage yield (APY). For Featured CD Account–%.

With a CD, you're only allowed an initial one-time deposit. If you're interested in making monthly or recurring deposits, a High Yield Savings Account. What you get with a CD · Competitive, fixed rates of return · Flexible terms · FDIC-insured up to the maximum permitted by law · Relationship rates for customers. Yes. We allow a range of account ownership types including Trust, Custodial (UTMA), Guardianship, and Estate. To open one of these account types, please call us. Opening an account online is easy. Start by getting rates based on your ZIP code, then select your terms and rates to see how to build your savings. You can easily apply online at TD Bank and open an account in minutes. If you'd like to talk to a TD banking specialist, they're available to assist you at The minimum balance to open a CD is $1, The annual percentage yield assumes that interest remains on deposit until. Are CDs FDIC-insured? Who should consider opening a CD? Savings accounts vs. CDs: How do they compare? What are the different types of CDs? Start by logging in to your account and choosing Trade > CDs. Select the Funds deposited at an FDIC-insured institution are insured, in aggregate, up. With a CD, you're only allowed an initial one-time deposit. If you're interested in making monthly or recurring deposits, a High Yield Savings Account. Certificates of Deposit (CDs) earn a fixed interest rate. A $1, minimum is required to open a CD. Please schedule a meeting to open a CD greater than. You'll get a maturity notice beforehand in case you'd rather redeem your CD. FDIC insurance. FDIC insurance up to the applicable jo0.site more. Opening a CD for a Child You can open a certificate of deposit (CD) for a child through a custodial account. An adult serves as the custodian, and the child. Learn more about how to open a Certificate of Deposit Account at HSBC, take advantage of HSBC promotional CD rates by apply online today. Earn a higher rate of interest over a standard BECU savings account, with low opening balance requirements and flexible options. Open account. 3 great reasons why you should open a CD account. More for your Your CD account is FDIC-insured up to $, What is APY? Annual. Lock in these CD Specials when you open today · Find out how much you could earn with a BMO CD · pop-up window · Save with a guarantee · Is a Certificate of Deposit. What is the process for opening a business CD? How to get a certificate of deposit · Step 1: Log on · Step 2: Select “Open a CD” · Step 3: Add money to your CD account. If you're wondering how to invest in CDs: You deposit a specific amount of money—say $5, or $10,—into an account and agree to keep it there for a set. Generally, a business CD works like a personal CD: The account pays a fixed rate of interest over a set "term," or period of time. When the term is completed.

What If You Lost A W2

Contact your employer to attempt to obtain your W · If you still haven't received it by February 14, contact the IRS at and provide as much. If you've separated within 13 months, you can login to your myPay account to get your W2. If you can't access your myPay account, you can submit a tax. You should first request a replacement from your employer. If this option is not available you can request a copy of your account transcript from the IRS. Ask your employer for a new W-2 if you lost the original one. If you have additional questions on where to include different types of income, or where to enter. Most NYC employees can get a copy of their W-2 by logging into NYCAPS ESS from Cityshare. You can also request a duplicate W-2 from your agency payroll office. Log in to using your user ID and password. · Scroll to the Individual Income Tax portion of the page and select “Submit a Credit Claim” located in the Tax. It is recommended that you contact the necessary employer and request a copy of the form that was issued to you. Sometimes an employer may not be able to. You may also call the IRS self-service line at to order your transcript(s). If you order by phone, follow the prompts and select 3, then 1 to. Call them and see if they'll issue or reissue the W2s. You can file an extension if they have to mail it to you. Since it sounds like you. Contact your employer to attempt to obtain your W · If you still haven't received it by February 14, contact the IRS at and provide as much. If you've separated within 13 months, you can login to your myPay account to get your W2. If you can't access your myPay account, you can submit a tax. You should first request a replacement from your employer. If this option is not available you can request a copy of your account transcript from the IRS. Ask your employer for a new W-2 if you lost the original one. If you have additional questions on where to include different types of income, or where to enter. Most NYC employees can get a copy of their W-2 by logging into NYCAPS ESS from Cityshare. You can also request a duplicate W-2 from your agency payroll office. Log in to using your user ID and password. · Scroll to the Individual Income Tax portion of the page and select “Submit a Credit Claim” located in the Tax. It is recommended that you contact the necessary employer and request a copy of the form that was issued to you. Sometimes an employer may not be able to. You may also call the IRS self-service line at to order your transcript(s). If you order by phone, follow the prompts and select 3, then 1 to. Call them and see if they'll issue or reissue the W2s. You can file an extension if they have to mail it to you. Since it sounds like you.

A copy of your W-2 will then be mailed within two weeks. If we do not receive an email with this subject line, we will assume you no longer need a copy of your. If your employer can't be reached, you should contact the IRS. Key Actions. Is your W-2 missing or incorrect? Contact the IRS. If you are unable to view your W-2 form after successfully completing your consent, ensure that the pop-up blocker is turned off for your web browser and verify. And if you fail to do so, the IRS will likely send you a letter requesting your missing document. However, if you fail to include a W-2 because you don't have. Lost Form W-2—Reissued statement. If an employee loses a Form W-2, write “REISSUED STATEMENT” on the new copy and furnish it to the employee. Make the process of distributing annual tax forms more efficient by providing employees online, self-service access. If you decide only to provide the forms. The IRS will also send you Form , which you can use if you do not receive the missing form in time to file your taxes. When filling out your Form you. Requests for copies of your W-2(s) must be made to your employer. If your employer is unable to provide a copy, you will need to request a substitute income. The cost to replace a lost or damaged W-2 is currently $5. For further information and instructions please contact the Payroll Administration Division. 3. I. As earlier stated, losing your W2 form shouldn't throw you into panic mode. If the online search fails to bear fruit, you need to get in touch with the employer. If your W-2 Form is not legible or if you have lost it, contact your employer and request another. If you have not received your W-2 Form, and it is after. You may also call the IRS self-service line at to order your transcript(s). If you order by phone, follow the prompts and select 3, then 1 to. Ask your employer for a duplicate W If you lost, misplaced, or never received your W-2 form, ask your employer for a copy. A lost W-2 could be troublesome when filing tax returns and could even cause you to file late, which would result in penalties. If you're dealing with a lost or. Form W-2, Wage and Tax Statement, is prepared by your employer. If you did not receive your W-2, contact your employer. Employers are required to issue W If you forget to file a W2, you will still receive a return. However, if your tax filing error will cause you to owe additional tax, you must file an amendment. If an individual did not receive a W-2 from an employer, that person should contact the IRS at for further instructions. Individuals who lose a W The IRS will also send you Form , which you can use if you do not receive the missing form in time to file your taxes. When filling out your Form you. Electronic copies of W-2s are available in HIP for calendar year onward. To obtain a copy of an older W-2, employees must request a copy from their payroll.

401k After Tax Contribution

An after-tax contribution is money paid into a retirement or investment account after income taxes on those earnings have already been deducted. Yes, the RMD will include pro rated pre tax and post tax amounts. The R issued by the plan will show the gross distribution and the taxable amount in Box 2a. Roth is after tax and the earnings become tax free once you reach and 5 years vested. The basis is always available tax free and penalty. What are after-tax accounts? After-tax accounts within a (k) or similar workplace retirement plan hold employee after-tax contributions and attributable. The secret weapon of the after-tax contribution is the ability to roll the after-tax (k) contributions into a Roth IRA without incurring any tax liability. Q: Does your plan allow for after-tax contributions? A: While not allowed by all plans, if an after-tax contribution option is available, details of the. In retirement, withdrawals of after-tax contributions would be tax-free, but any earnings on the after-tax contributions would be taxed as ordinary income. If. If you determine that it is permissible and appropriate in your situation, then you can set one up by making after-tax contributions to your (k), and. Contributions. Designated Roth employee elective contributions are made with after-tax dollars. Roth IRA contributions are made with after-tax dollars. An after-tax contribution is money paid into a retirement or investment account after income taxes on those earnings have already been deducted. Yes, the RMD will include pro rated pre tax and post tax amounts. The R issued by the plan will show the gross distribution and the taxable amount in Box 2a. Roth is after tax and the earnings become tax free once you reach and 5 years vested. The basis is always available tax free and penalty. What are after-tax accounts? After-tax accounts within a (k) or similar workplace retirement plan hold employee after-tax contributions and attributable. The secret weapon of the after-tax contribution is the ability to roll the after-tax (k) contributions into a Roth IRA without incurring any tax liability. Q: Does your plan allow for after-tax contributions? A: While not allowed by all plans, if an after-tax contribution option is available, details of the. In retirement, withdrawals of after-tax contributions would be tax-free, but any earnings on the after-tax contributions would be taxed as ordinary income. If. If you determine that it is permissible and appropriate in your situation, then you can set one up by making after-tax contributions to your (k), and. Contributions. Designated Roth employee elective contributions are made with after-tax dollars. Roth IRA contributions are made with after-tax dollars.

If your plan allows for after-tax contributions, you can save beyond the pre-tax annual contributions limits—and still have your contributions grow tax-free. cannot exceed $53, or $59, if over age Keep in mind a few rules surrounding this change. Allocating after-tax contributions to a Roth IRA is possible. However, after-tax contributions don't have the same tax advantages that Roth contributions have. So, with the Roth in-plan conversion feature, you can convert. Choose the type of plan your employer sponsors. Choices include an option for pre-tax ("traditional" contributions) and after-tax ("Roth" contributions). Aftertax (k) contributions is that they are allowable on top of the basic traditional or Roth contributions, making them ideal for heavy savers. Guideline is unable to support either of these provisions. Allowing voluntary after-tax contributions would let participants make backdoor Roth rollover. You can make after-tax Roth contributions to the UPS Savings Plan. Is this the right direction for you? Roth (k) contributions offer flexibility to. After-tax (k) contributions are post-tax dollars you invest in an employer-sponsored (k) plan above and beyond your annual effective deferral limit. (k) annual contribution limits ; Pre-tax and/or Roth after-tax contributions (g limit), $23, ; Adobe company maximum match*, $10, ; Traditional. It provides two important advantages. First, all contributions and earnings are tax deferred. You only pay taxes on contributions and earnings when the money is. After-tax contributions are contributions from compensation (other than Roth contributions) that an employee must include in income on his or her tax return. After-tax Roth Contributions ; Am I taxed on withdrawals? Yes. Because you contributed money before taxes are assessed, you are taxed when you withdraw the money. An after-tax (k) contribution is just that — made after taxes are paid. Like a Roth (k), earnings grow tax-deferred. Roth (k) · Taxes: You make after-tax contributions and don't pay tax on qualified withdrawals in retirement · Salary deferral limits for $22, ($30, You can “fill the gap” through Keogh Plan contributions and with Traditional After-Tax contributions in the. (k) Plan. * IRS limits for Keogh and (k). Your contributions are not taxed at the time of investment. Instead, taxes are paid on withdrawals, including any earnings. Getting a tax break at the time of. They are broken out because the pre 87 after tax contributions can be distributed separately from pre tax amounts and from their earnings. The secret weapon of the after-tax contribution is the ability to roll the after-tax (k) contributions into a Roth IRA without incurring any tax liability. After-tax k contributions allow you to contribute additional money into your k after you've already paid taxes. Post-tax dollars mean you already. When you withdraw pretax contributions from your (k) plan, you must pay ordinary income tax on the amount withdrawn. Also, if you take a withdrawal before.

Is Real Estate Classes Hard

Whether you are a seasoned professional or a fresh-faced beginner, passing the Michigan Real Estate Exam can feel like a daunting task. The California real estate exam is one of the most difficult, with a pass rate often under 50%. But don't worry! You can prepare yourself to take it to pass the. How Difficult Is The New York Real Estate Licensing Exam? The pass rate for the New York State Real Estate Salesperson Exam is 70%. In other words, it's a. How to get a real estate license in AZ · Complete all 90 hours of instruction online · Complete the 6 hour Contract Writing Course · Pass your school exam (state. Course Providers offer the qualifying and continuing education courses for Real Estate Salespersons. Deaf, hard of hearing and speech-disabled callers. This course makes the introduction to real estate graspable. Learning new information can be hard to process, but with the quizzes after every. It takes 77 hours of real estate coursework to become an agent, while a broker license requires hours and two years of practical experience. Kaplan Real Estate Classes. The Premier Real Estate Education Provider Is being a real estate agent hard? Real estate is a rewarding career path. Real estate exams are designed to be difficult to pass, so they can weed out people who will not be skilled agents. Though the pass rate varies based on the. Whether you are a seasoned professional or a fresh-faced beginner, passing the Michigan Real Estate Exam can feel like a daunting task. The California real estate exam is one of the most difficult, with a pass rate often under 50%. But don't worry! You can prepare yourself to take it to pass the. How Difficult Is The New York Real Estate Licensing Exam? The pass rate for the New York State Real Estate Salesperson Exam is 70%. In other words, it's a. How to get a real estate license in AZ · Complete all 90 hours of instruction online · Complete the 6 hour Contract Writing Course · Pass your school exam (state. Course Providers offer the qualifying and continuing education courses for Real Estate Salespersons. Deaf, hard of hearing and speech-disabled callers. This course makes the introduction to real estate graspable. Learning new information can be hard to process, but with the quizzes after every. It takes 77 hours of real estate coursework to become an agent, while a broker license requires hours and two years of practical experience. Kaplan Real Estate Classes. The Premier Real Estate Education Provider Is being a real estate agent hard? Real estate is a rewarding career path. Real estate exams are designed to be difficult to pass, so they can weed out people who will not be skilled agents. Though the pass rate varies based on the.

The state exam is not easy. It's also important to ask your real estate education provider if they offer any guarantees for prelicensing students. Your real. The state exam is not easy, so you will need to be diligent about your studies. Find out precisely what your real estate education provider does to ensure you. To engage in the practice of real estate brokerage in Kentucky, all individuals must obtain a sales associate or broker license from the Kentucky Real Estate. Get your Texas Real Estate license with these convenient, Online Interactive Qualifying Education (QE) classes from Champions School of Real Estate. Course Providers offer the qualifying and continuing education courses for Real Estate Salespersons. Approved Real Estate Qualifying Education Schools. Learn the requirements and how to apply for a real estate broker license. Who needs a license? Anyone who acts on behalf of a real estate firm to perform real. Class Requirements: Complete hour Pre License course. *Failure to meet this grade will require you to retake the course. Luckily, the Georgia Academy of. Texas is largely considered the most difficult state to obtain your real estate license. Many factors go into this, primarily the sheer size of the state. How to get a real estate license in AZ · Complete all 90 hours of instruction online · Complete the 6 hour Contract Writing Course · Pass your school exam (state. To attend College or Live Classes is extremely costly, inconvenient and time consuming ( hours in a classroom). Even video or audio programs require students. This test can be very challenging for many aspiring realtors. In fact, only 50% of people pass the real estate exam on the first try. Failing the exam can be. The area of the exam that is considered the most challenging varies from person to person, but many people find that the Practice of Real Estate and Disclosures. Learn the requirements and how to apply for a real estate broker license. Who needs a license? Anyone who acts on behalf of a real estate firm to perform real. 5) Physical Stamina – Listing and selling properties requires hard work and flexible hours. If you need help finding a course or have questions about becoming. Is the Mississippi Real Estate Exam hard? The level of difficulty for real estate education varies for each student. That's why it's so important to enroll. To engage in the practice of real estate brokerage in Kentucky, all individuals must obtain a sales associate or broker license from the Kentucky Real Estate. How difficult is the state real estate exam? Most Tennessee agents will describe the real estate licensing exam as “not easy.” There are questions on the. real estate agent in Alabama can be difficult on its own. The cost of an agent license in AL can vary considerably depending on the price of your Alabama real. How difficult is New York State's real estate license exam? Class Requirements: Complete hour Pre License course. *Failure to meet this grade will require you to retake the course. Luckily, the Georgia Academy of.

C# For Unity Course

In this series of tutorials, we'll discuss the major foundations of scripting with C# in Unity and apply what we've learned into a mini project. 7 Best Unity Game Development Online Courses for Programmers · 1. Complete C# Unity Developer 2D: Learn to Code Making Games · 2. The Complete C#. Each of the courses includes exercises designed to teach you small concepts in C# and Unity. You'll also develop several larger C# console applications. Over the years, the Learning C# by Developing Games with Unity series has established itself as a popular choice for getting up to speed with C#, a powerful and. A prerequisite knowledge of basic C# is required for full understanding of this series. Tutorials Point is a leading Ed Tech company striving to provide the. Any student who knows the basics of programming in C# can master the basics of game development with Unity. For students from 10 years old. Learn how to design and develop video games. Learn C# in Unity Engine. Code your first 3D Unity games for web, Mac and PC. To really learn C# you should read Learning C# programming with Unity by Alex Okita Learning C# Programming with Unity 3D Book Online at Low. learn how to program Unity games using C#. The first course assumes no programming experience, and throughout the 5 courses in the specialization you'll learn. In this series of tutorials, we'll discuss the major foundations of scripting with C# in Unity and apply what we've learned into a mini project. 7 Best Unity Game Development Online Courses for Programmers · 1. Complete C# Unity Developer 2D: Learn to Code Making Games · 2. The Complete C#. Each of the courses includes exercises designed to teach you small concepts in C# and Unity. You'll also develop several larger C# console applications. Over the years, the Learning C# by Developing Games with Unity series has established itself as a popular choice for getting up to speed with C#, a powerful and. A prerequisite knowledge of basic C# is required for full understanding of this series. Tutorials Point is a leading Ed Tech company striving to provide the. Any student who knows the basics of programming in C# can master the basics of game development with Unity. For students from 10 years old. Learn how to design and develop video games. Learn C# in Unity Engine. Code your first 3D Unity games for web, Mac and PC. To really learn C# you should read Learning C# programming with Unity by Alex Okita Learning C# Programming with Unity 3D Book Online at Low. learn how to program Unity games using C#. The first course assumes no programming experience, and throughout the 5 courses in the specialization you'll learn.

This course is all about starting to learn how to develop video games using the C# programming language and the Unity game engine on Windows or Mac. Kick off your career in tech with tech bootcamps or preuniversity courses in AI/ML, Game Development, Product Management, Software Engineering, and more. This specialization is intended for beginning programmers who want to learn how to program Unity games using C#. Class Central's Top Unity Courses · Unity. Unity Essentials · Code Monkey. Learn Unity Beginner-Intermediate - Unity Tutorial · Code Monkey · Complete C# Unity. Design & Develop Video Games. Learn C# in Unity Engine. Code Your first 3D Unity games for web, Mac & PC. Students learn to use game objects, models, and levels to create game environments. Kids and teens will program interactions with C#, think in 3D to create. Intro to Unity 3D & C# coding course is ideal for senior High school students. It covers the fundamentals of Unity engine and C# language. Dive into scripting, in this course we will cover the fundamentals of C#. Recommended Unity versions. 4.x - Unity Essentials. Programming. This is a beginner-friendly course. You don't need any Unity or Programming knowledge to enroll. Of course, you'd need a PC/Mac to run Unity. This specialization is intended for beginning programmers who want to learn how to program Unity games using C#. Unity Code Monkey, Learn Game Development with Unity and C# taught by a Professional Indie Game Developer. C# in unity and if SoloLearn is useful for learning any of this? · Yup. · Tbh I completed the C# course for Unity, but when I started in Unity I thought: "What. Learning C# by Developing Games with Unity Kickstart your C# programming and Unity journey by building 3D games from scratch [Ferrone, Harrison] on. Unity C# Scripting Fundamentals is the project for you because you will end with a scripted prototype in Unity. First, you'll learn to understand how variables. Yes, you should definitely learn the basics of C# in SoloLearn, then try it in Unity and as you develop your game or whatever in Unity, you can search for more. In order to use the Unity API, every C# script you create must call the API at the beginning of the script. Unity makes this easy to get started by allowing. Trending courses: Cert Prep: Unity Certified Associate Game Developer Scripting with C# 2h 21m Course. Are there any prerequisites for this course? · No prior programming knowledge required. You will learn everything from scratch, including the C# programming. In this 10 week live course, you will learn how to use the Unity engine, Unity3D programming library, and program with C#. Learn C# syntax first and grasp an unstanding of it. Once you've learnt it as a language, you'll understand how to use it with Unity. I.